Mortgage Lead Generation Regulations

Mortgage lenders and mortgage brokers the term mortgage broker does not include a lead generator.

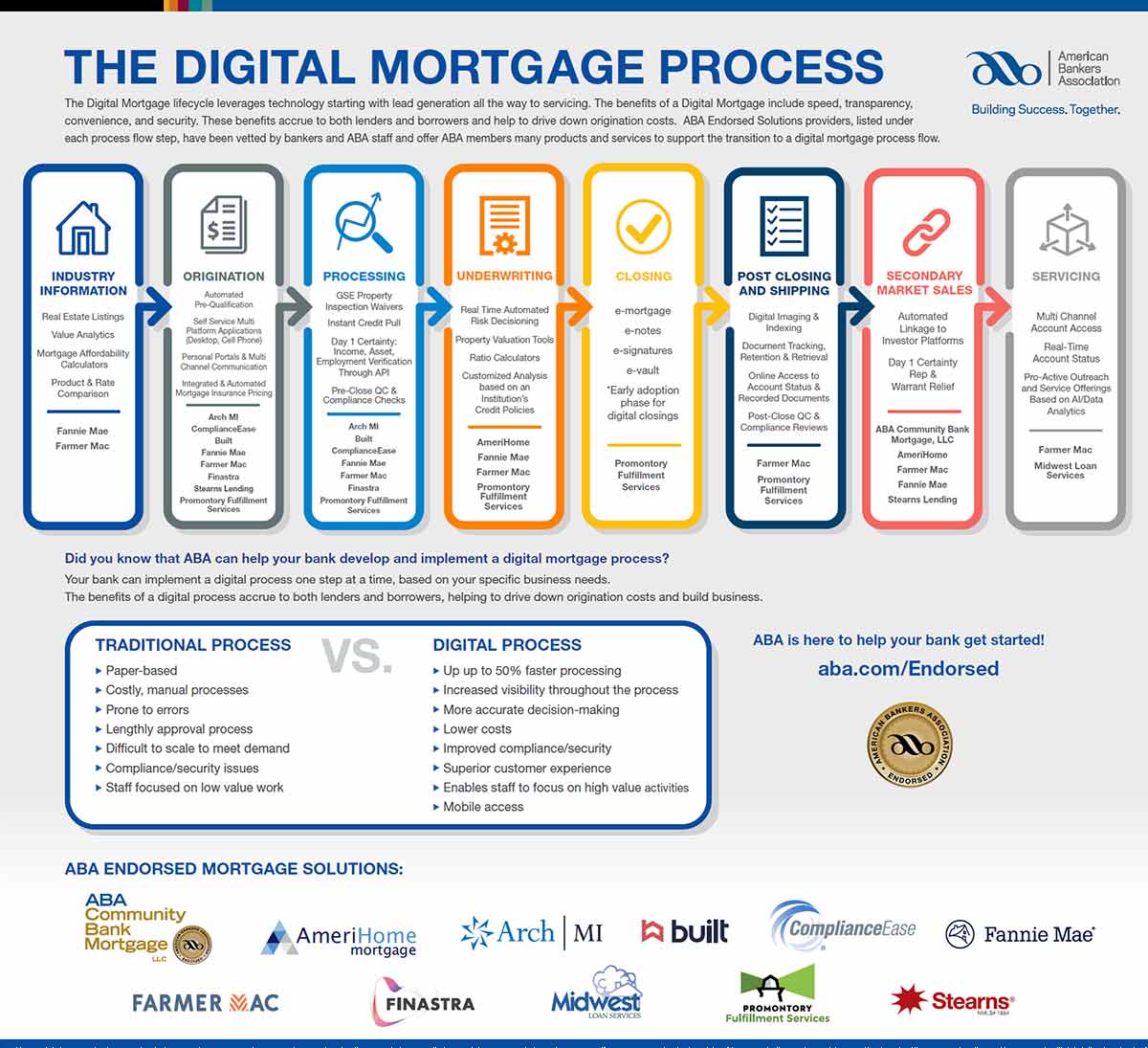

Mortgage lead generation regulations. The regulatory environment within the real estate industry is changing fast and mortgage professionals must be on top of the changing laws. Mortgage lending and regulations mortgage acts and practices advertising rule and. If the lead generation company acts as a special kind of mortgage broker then it may be best to stay away because this could violate the standards associated with the loan officer qualifying rule mentioned above which became effective on january 1 2014. Lead generation advertising and marketing leadscouncil october 23 2012 3 pm 4 pm et webinar.

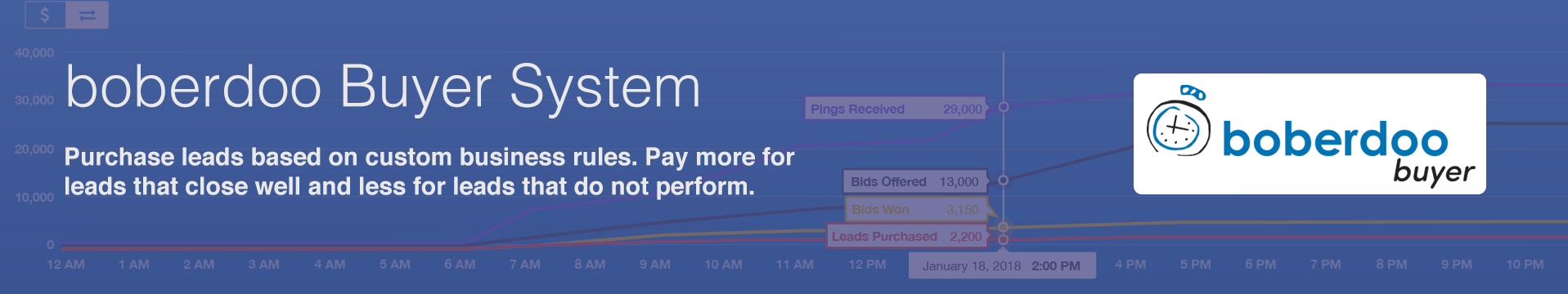

Federal and state mortgage lending laws and regulations federal mortgage assistance relief services rule department of education requirements truth in lending act. Mortgage companies and loan officers often augment their marketing efforts through mortgage lead purchasing loan originators must be aware of the regulatory implications of these types of lead generation activities. If the lead generation company acts as a special kind of mortgage broker then it may be best to stay away because this could violate the standards associated with the loan officer qualifying rule mentioned above which became effective on january 1 2014. The lead generator did not admit or deny any wrongdoing under the terms of the settlement.

Leads contain personal information such as consumers names telephone numbers home and email addresses references and employer information. The settlement reflects that the ftc remains focused on lead generation and more specifically mortgage advertising even though it shares enforcement authority for nonbank mortgage advertising with the consumer financial protection bureau cfpb. Some lead generation companies will get leads via the phone too. Fomichev and gasparyan co founded t3leads in 2005.

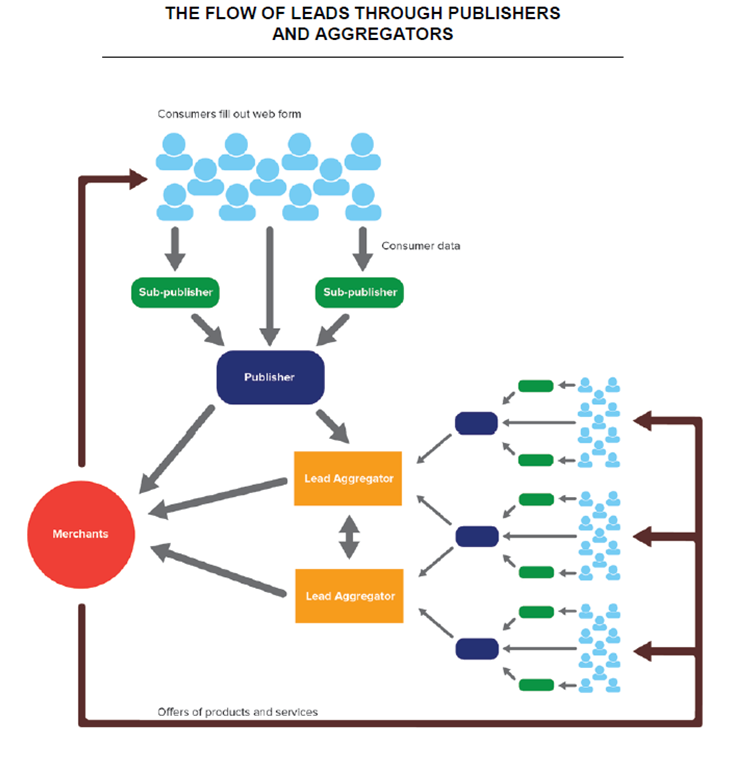

Lead generator means a person who engages in a form of marketing activity in which the person collects and transmits a prospective borrower s contact information and minimal. At one time outbound cold calling was a popular way to generate mortgage leads but this was banned in 2004 when the financial services authority fsa began to regulate mortgages. Three sets of regulations were approved and filed by the secretary of state. Lead aggregators buy consumer information called leads from lead generators websites that market payday and installment loans.