Multi Generational Ira Calculator

While alive the ira owner begins taking rmd payments at age 72 or 70 if born before 7 1 1949 using a factor from the irs uniform lifetime table to calculate the distribution unless the spouse is more than 10 years younger than the owner and is the owner s sole.

Multi generational ira calculator. Also gain further understanding of roth iras experiment with other retirement calculators or explore hundreds of other calculators covering finance math fitness health and many more. To illustrate how a multi generational ira strategy works consider. A multi generational ira is an individual retirement arrangement that is advantageous not only to first generation beneficiaries upon the account holder s death but also to subsequent heirs who. Free inflation adjusted roth ira calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

They make the most sense for people who do not depend on an ira for income in their retirement years and can try. For those who inherited an ira in 2019 or before please use our inherited ira rmd calculator to estimate annual withdrawals you may need to take. The ira owner names his her spouse as sole primary beneficiary of the ira. For those who turned 70 in 2019 or before and have a traditional rollover sep or simple ira please use our traditional ira rmd calculator to estimate your annual distributions.

She has 300 000 of retirement assets in three employer sponsored retirement plans and two iras. A multigenerational ira mgira also known as a stretch ira or dynasty ira is simply a wealth transfer method that allows you to stretch your accumulated ira assets over a couple of generations. In other words it allows you to pass your ira to a beneficiary down a generation or even several generations to your grandchildren. Alice who s 60 years old and ready to retire.

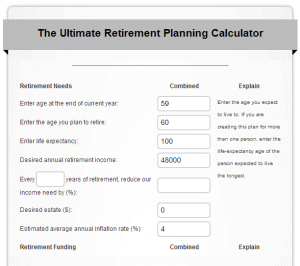

Traditional ira calculator contributing to a traditional ira can create a current tax deduction plus it provides for tax deferred growth. The roth ira calculator defaults to a 6 rate of return which should be adjusted to reflect the expected annual return of your investments. It works best if you don t think you will need all of your ira assets for retirement income. A multi generational ira is an individual retirement account that allows you to leave the money to beneficiaries after your death.

Multigenerational ira aka stretch ira aka dynasty ira. Free inflation adjusted ira calculator to estimate growth tax savings total return and balance at retirement of traditional roth ira simple and sep iras. Also gain further understanding of different types of iras experiment with other retirement calculators or explore many more calculators covering finance math fitness and health. A roth ira is a tax advantaged individual.