Multi Generational Roth Ira

These iras also are also called stretch iras legacy iras or eternal iras.

Multi generational roth ira. Multi generational spray trusts roth conversions spousal rollovers and the new spousal rollover trap iras payable to crts ira trusts for state income tax savings life insurance solutions qualified charitable contributions naming a charity as a beneficiary. To illustrate how a multi generational ira strategy works consider. In other words it allows you to pass your ira to a beneficiary down a generation or even several generations to your grandchildren. A multi generational ira is an individual retirement arrangement that is advantageous not only to first generation beneficiaries upon the account holder s death but also to subsequent heirs who.

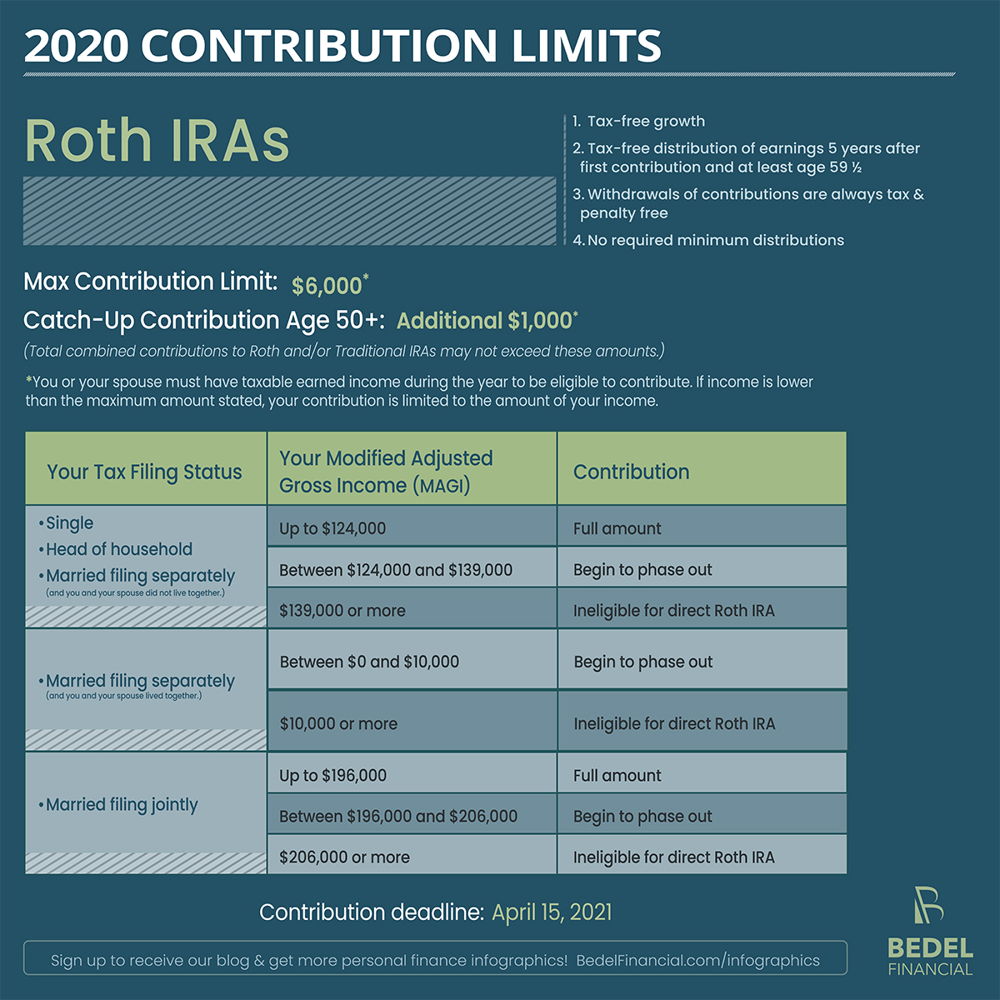

So savers contribute after. She has 300 000 of retirement assets in three employer sponsored retirement plans and two iras. Unlike traditional iras you are not required to take minimum distributions at age 72. Multi generational iras which are also known as stretch iras apply that principle but look at a longer time frame naming a child as a beneficiary.

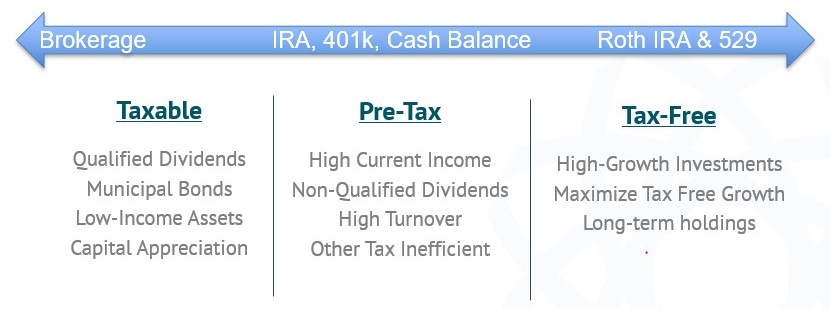

A multi generational ira is an individual retirement account that allows you to leave the money to beneficiaries after your death. A roth ira is a type of ira that allows you to save money in a tax advantaged account and then withdraw it tax free in retirement which is considered to be age 59. Converting a traditional ira to a roth ira. Long term investment strategy instead of receiving disbursements from your ira when you turn 70 1 2 as required a stretch ira names your children or grandchildren as the beneficiaries.

Converting money or securities from a traditional ira or employer sponsored retirement plan into a roth ira allows you to take advantage of the tax free benefits of a roth ira. Referred to as the stretch ira or multi generational ira this will alleviate beneficiaries from immediate taxation on a lump sum or five year distribution which can be up to a 40 or. Alice who s 60 years old and ready to retire.

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg)