Parking Lot Resurfacing Capitalize Or Expense

Improvement decision tree final regulations considering the appropriate unit of property uop does the expenditure last updated 03 20 2015.

Parking lot resurfacing capitalize or expense. In an attempt to clarify matters the irs issued lengthy regulations explaining how to tell the difference between repairs and improvements. It may also extend the time of the depreciation deduction for several years. Illinois merchants trust co. Thus we would treat the parking lot sealing repair work as an expense and capitalize the re pavement work.

A capital improvement will add value to your property. Well on december 23. Deductible repairs and non deductible capital improvements. 103 106 1926 the court ex plained that repair and maintenance expenses are incurred for the purpose of keeping property in an ordinarily efficient operating condition over its probable useful life for the.

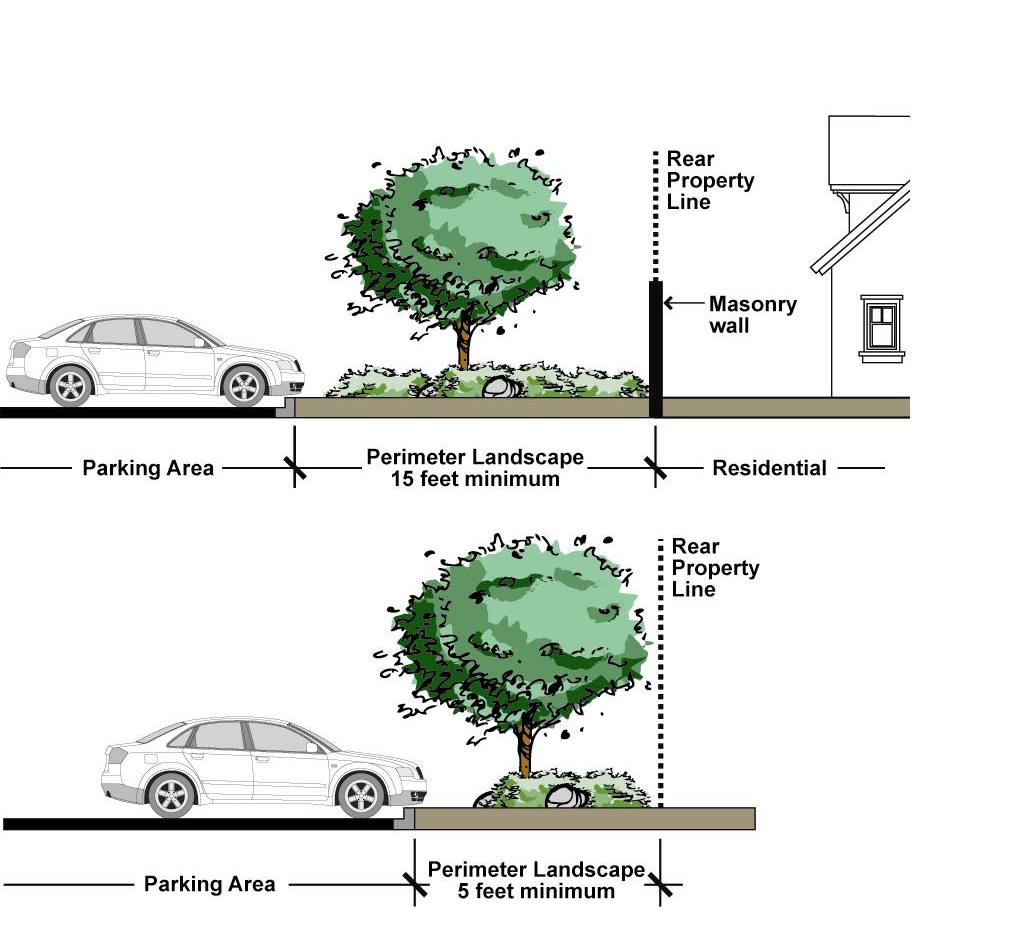

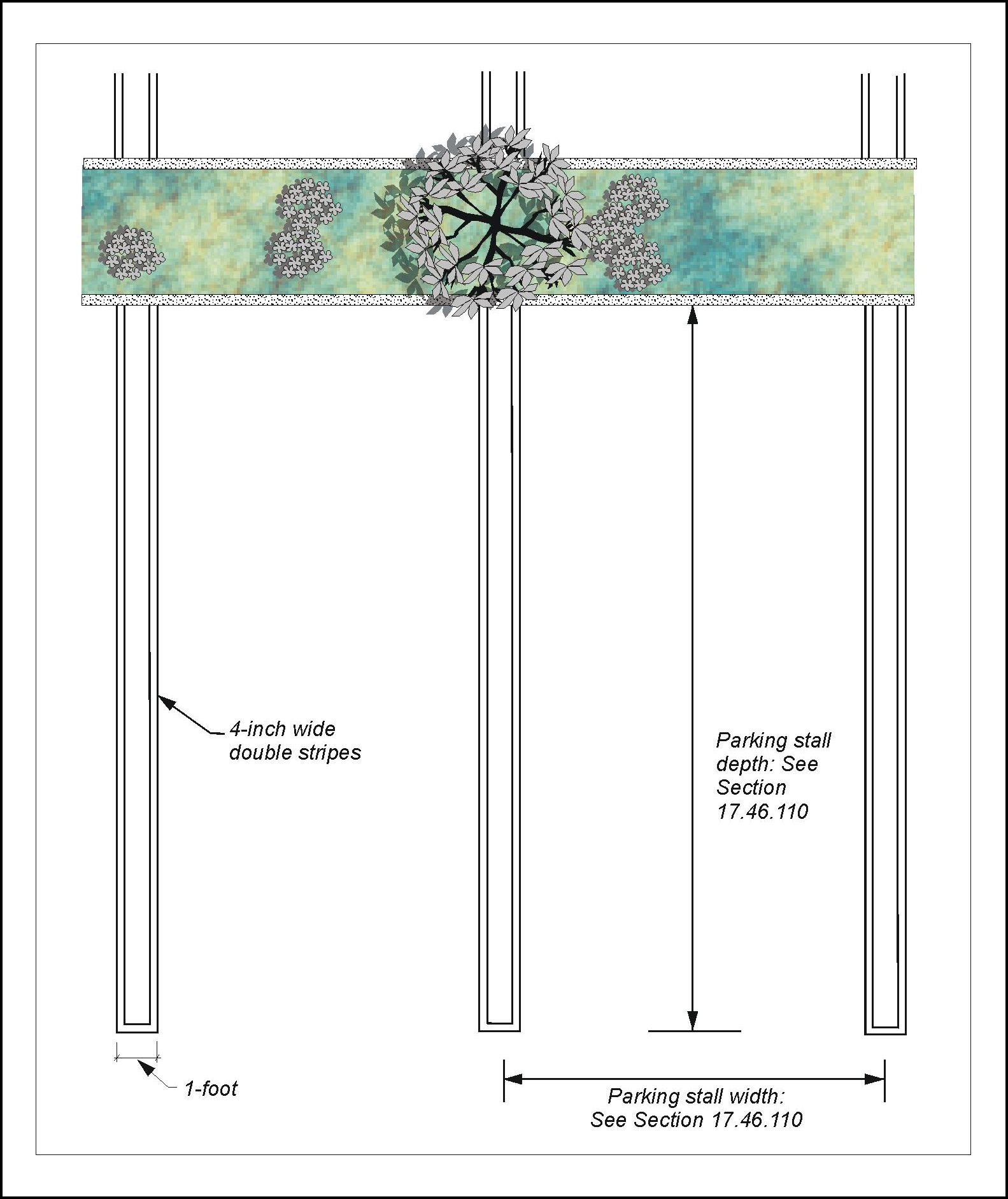

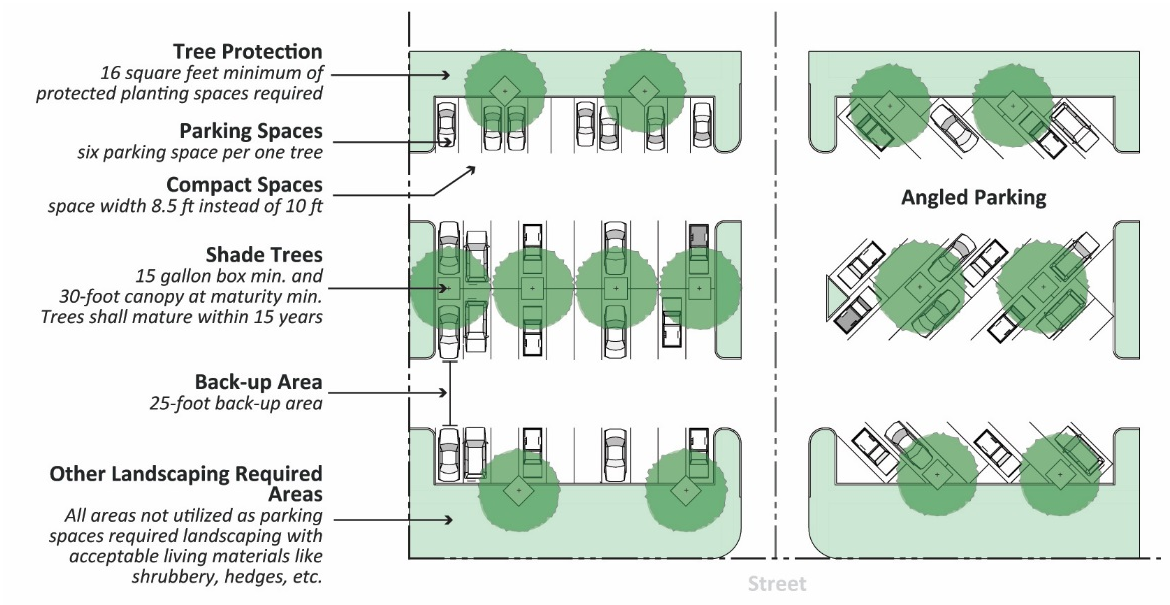

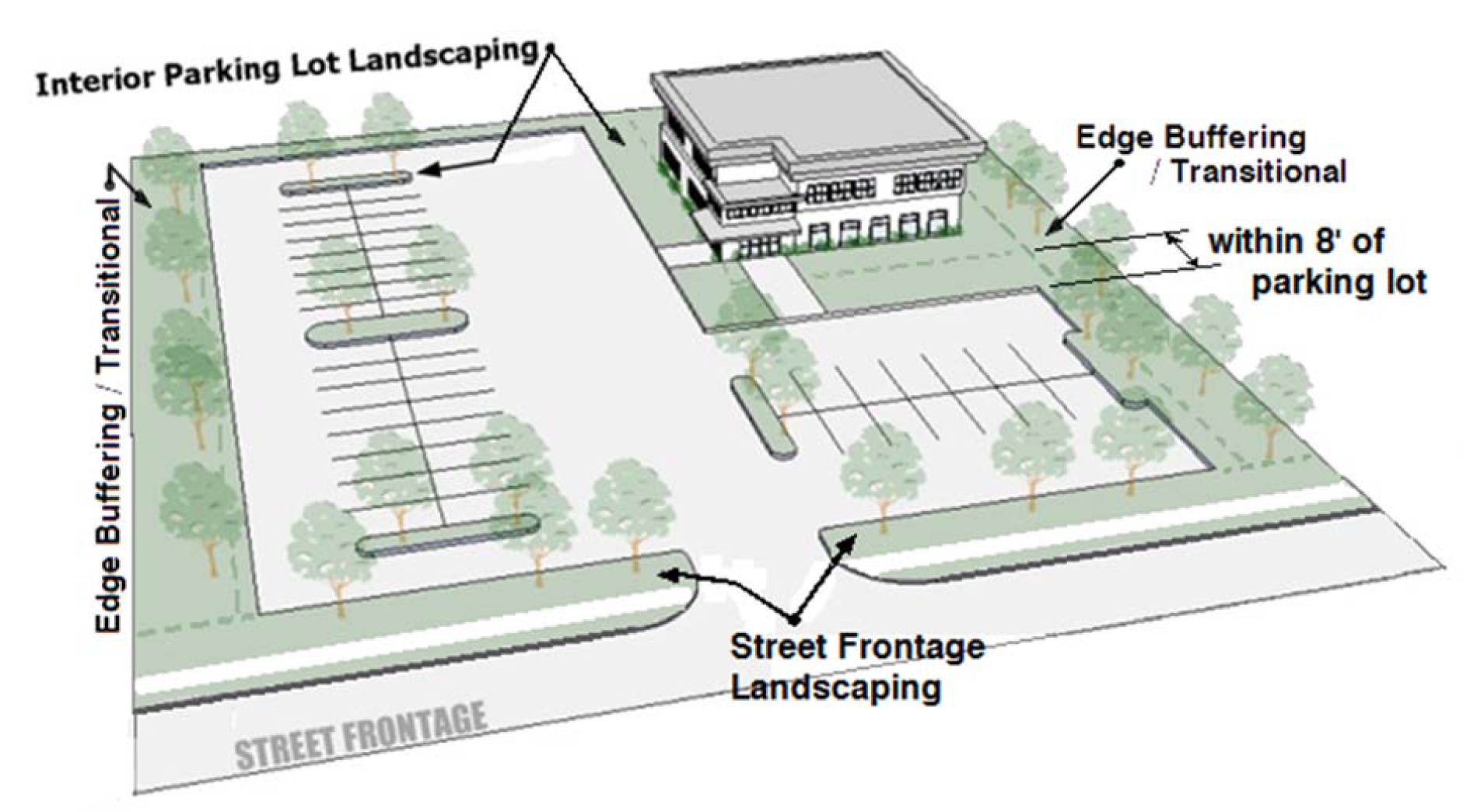

There has been much debate and controversy not to mention a number of court cases regarding whether or to what extent the amounts paid to restore or improve property are capital expenditures or deductible ordinary and necessary repair and maintenance expenses. Grade level surface parking area usually constructed of asphalt brick concrete stone or similar material. Capitalized asset versus expense posted on wednesday october 07 2015 share. Nationwide service 877 525 4462 kbkg com cop 2018 ll served llv 8202018 kbkg repair vs.

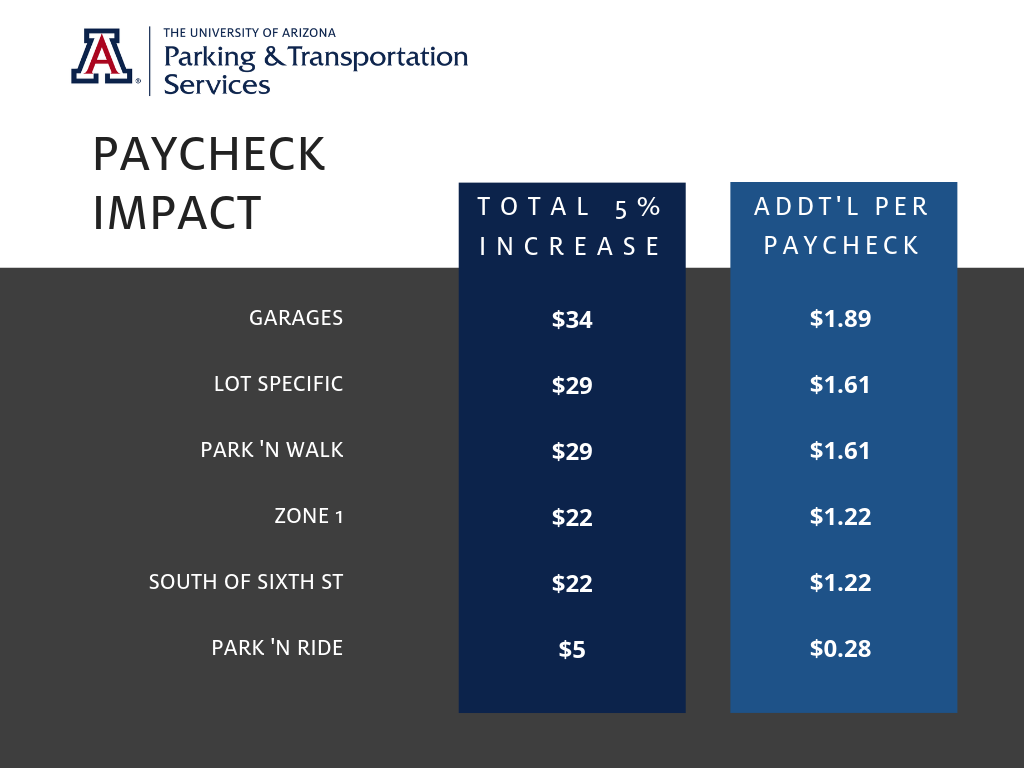

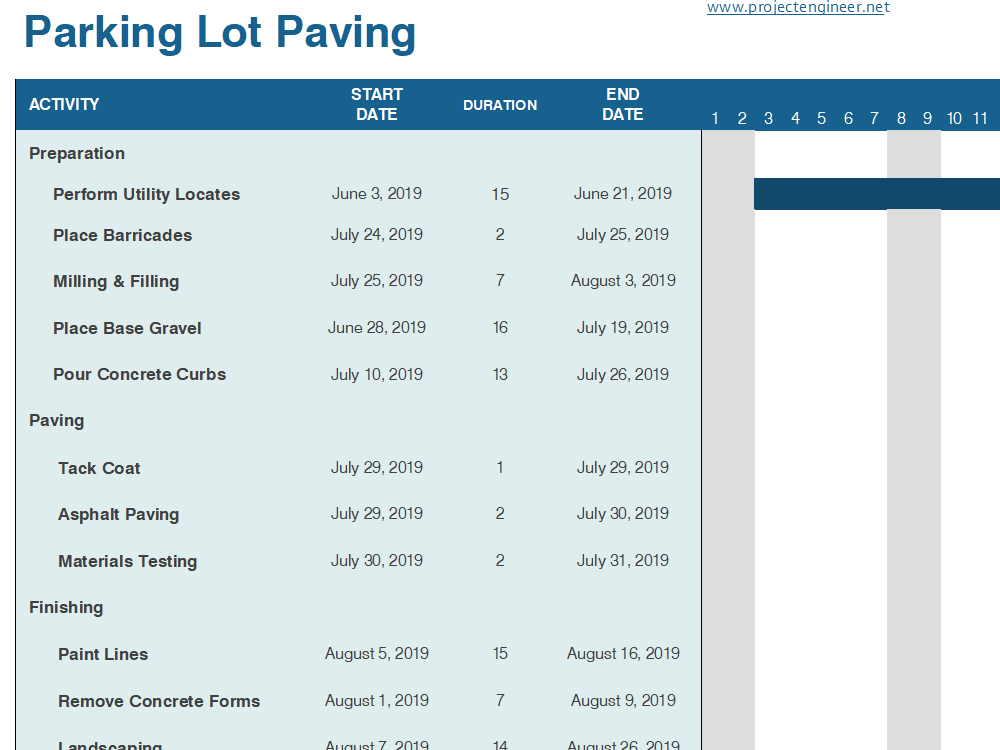

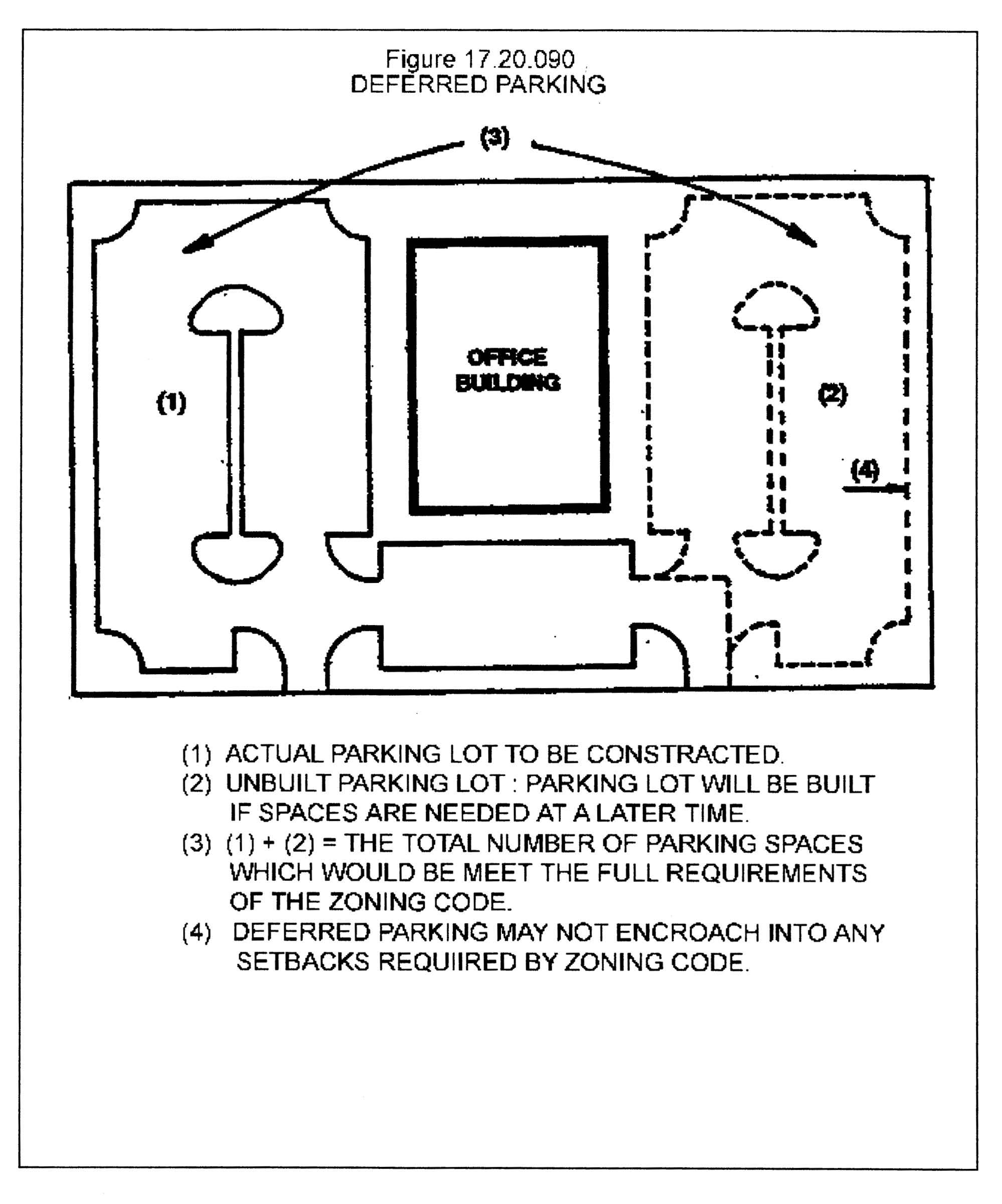

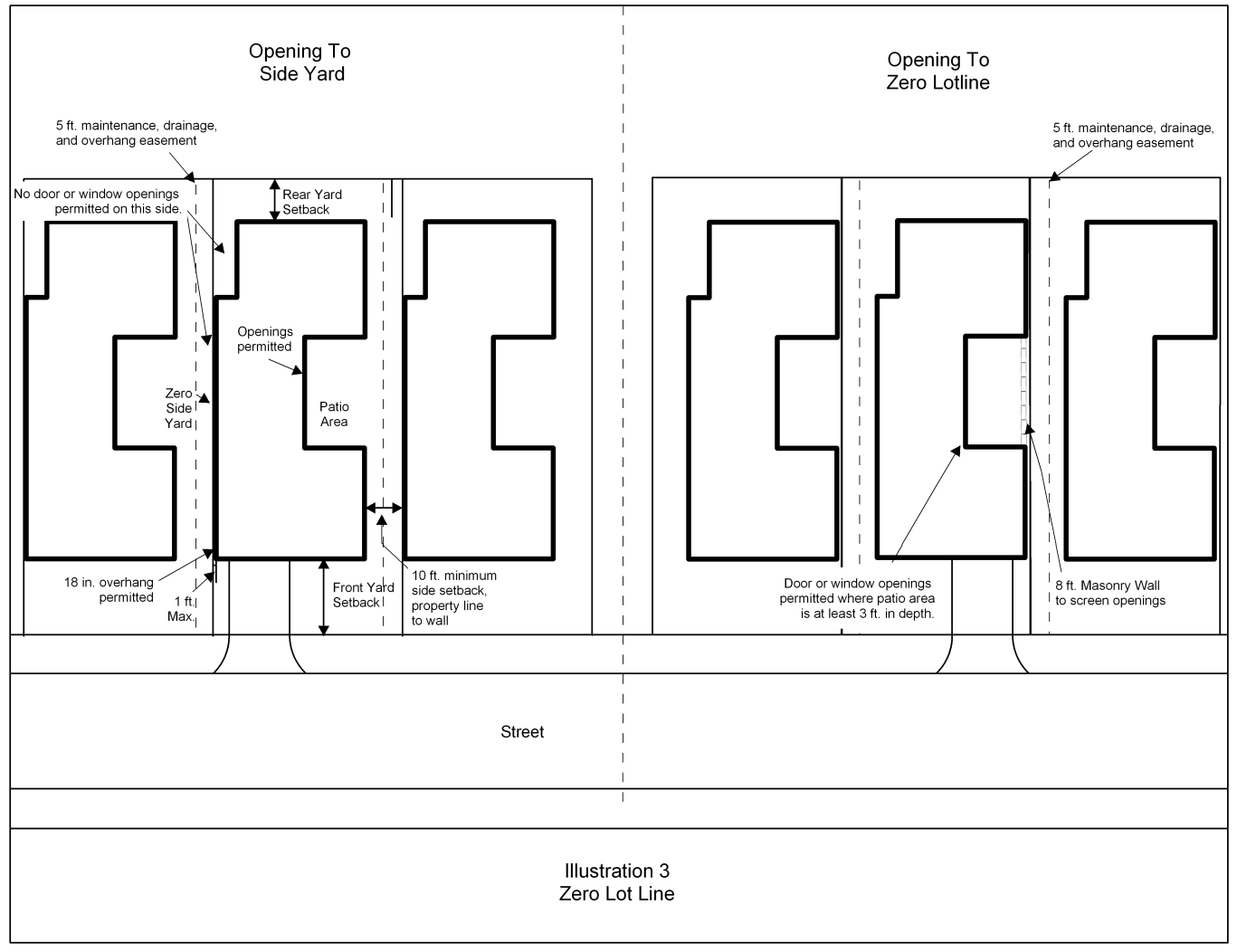

00 3 land improvements 15 years. If the repaving is a repair of an existing surface then it can be a repair. If this was an improvement then it can be treated as a capital expense and added to the cost basis and depreciated over time. Repairs and maintenance can be expenses fully in the year they are paid for.

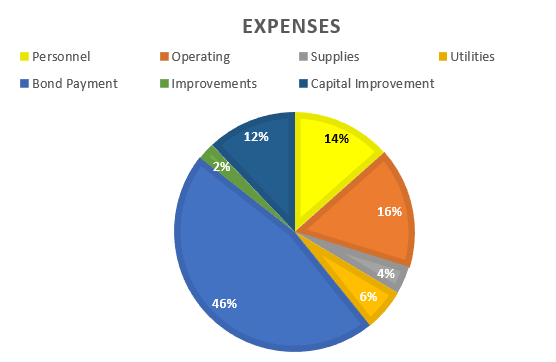

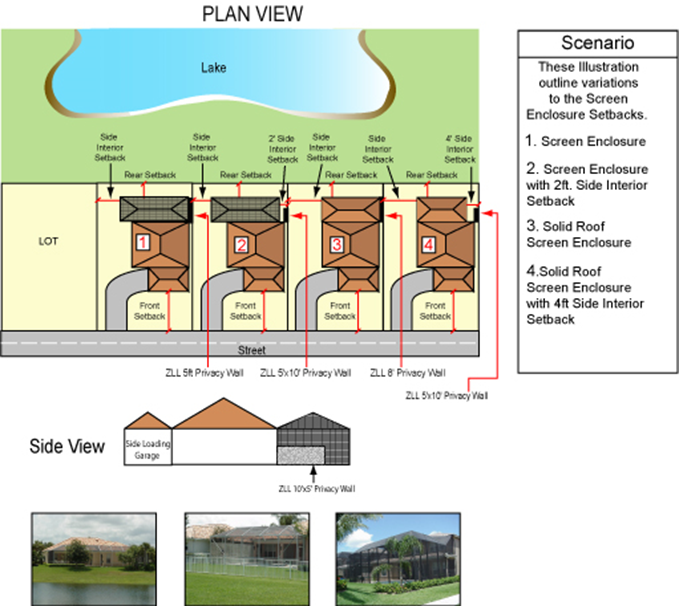

All nonprofit organizations should have a capitalization policy in place. This policy sets a threshold above which qualifying expenditures are capitalized as fixed assets and depreciated. Kbkg expressly disclaims any liability in connection with use of this document or its contents by any third party. Although some of these activities such as resurfacing a parking lot or replacing portions of concrete in a parking facility may be capitalized for book purposes the activities may be considered otherwise deductible.

Parking facilities routinely undergo repairs. For more details on current vs. Any replacement work would generally be capitalized and depreciated over time. Unfortunately telling the difference between a repair and an improvement can be difficult.

Category includes bumper blocks curb cuts curb work striping landscape islands perimeter fences and sidewalks. If the lot was partially paved and only parts need to be replaced then you likely have sufficient basis to treat it as an expense. Capital expenses refer to the article current vs capital expenses. On the other side the entire cost of a repair and maintenance expense such as fixing broken windows can be immediately deducted on your taxes leaving more money in your pocket by increasing your after tax income.